There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

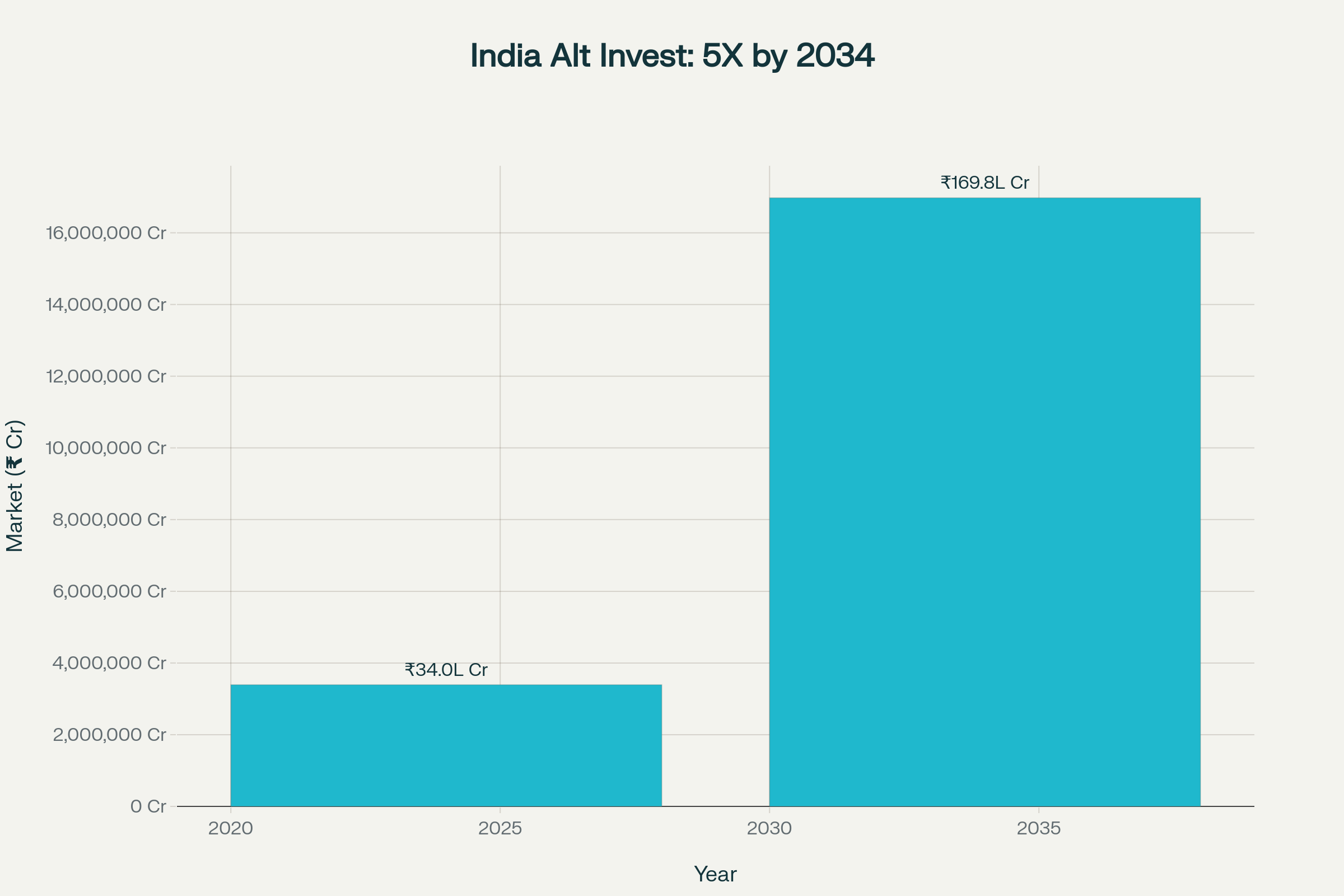

The ₹1,69,76,000 Crore Opportunity

Sat Nov 15, 2025

India's alternative investment market is exploding—set to grow 5x from ₹33,95,200 crore (2024) to ₹1,69,76,000 crore (2034). At the center of this boom? Specialized Investment Funds (SIFs)—a new asset class that's reshaping how HNI investors build wealth.

If you're a financial advisor, mutual fund distributor, or investor, this guide cuts through the jargon and shows you exactly what you need to know.

image: India's alternative investment market projected to grow 5x from ₹33,95,200 crore (2024) to ₹1,69,76,000 crore (2034) as per Avendus Capital report

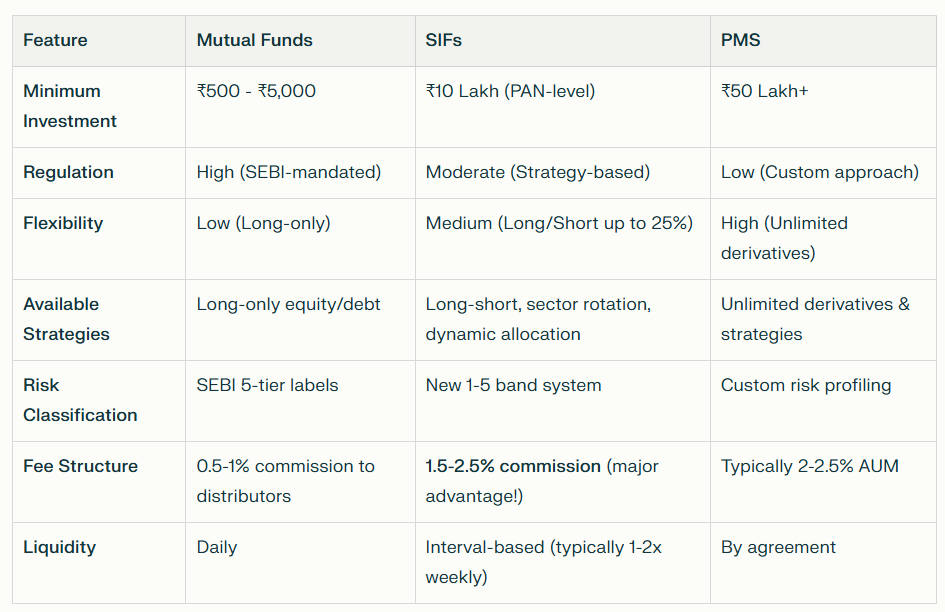

Think of SIFs as the "sweet spot" between mutual funds and Portfolio Management Services (PMS).

Why SIFs Matter for Distributors:

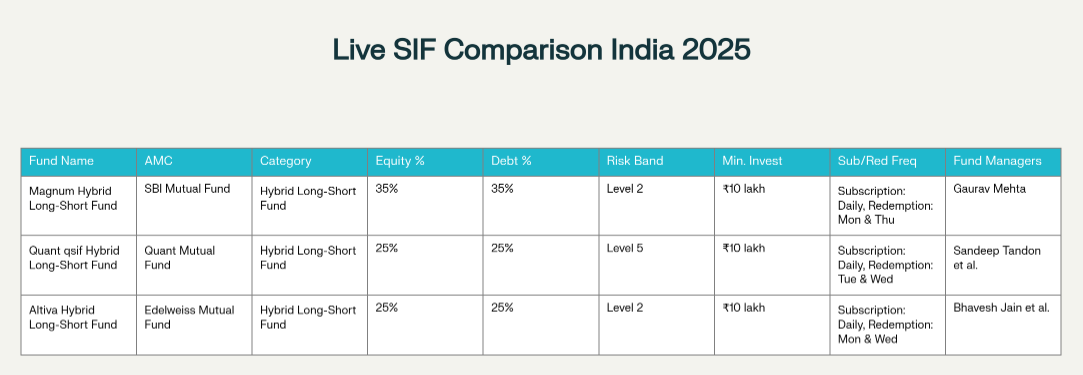

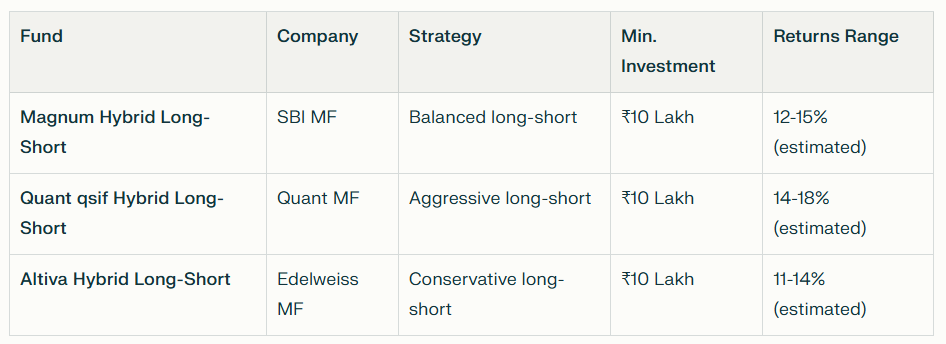

Feature comparison of top SIFs launched in India post 2025 to help distributors and investors efficiently evaluate options

Feature comparison of top SIFs launched in India post 2025 to help distributors and investors efficiently evaluate optionsJust 3 months after SEBI approval, three major SIFs have launched:

Current Status: These SIFs crossed ₹2,010 crore AUM by end of October 2025, with 10,212+ investors already on board. (Angel One Report)

Example: Buy Reliance (long) + Short HDFC (short) = Protected portfolio

Rotate money between 2-4 high-growth sectors based on market cycles. Today in tech, tomorrow in pharma.

Exploit interest rate differences between bonds. Complex, but generates steady returns even in flat markets.

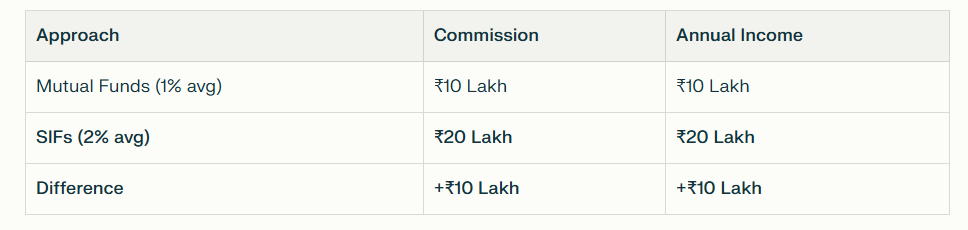

Scenario: You advise ₹10 crore HNI client

Over 5 years: ₹50 Lakh extra income from one large client alone.

Rajesh's Story:

Rajesh, a 45-year-old business owner, has ₹2 crore invested purely in large-cap mutual funds. In the 2024 market correction, his portfolio fell 18%.

With a SIF allocation:

Same 18% correction → MF portion drops ₹18 lakh, BUT SIF short hedges capture ₹8 lakh → Net loss only ₹10 lakh instead of ₹18 lakh

Result: Rajesh sleeps better, and the advisor (you) earns ₹20 lakh annually instead of ₹10 lakh.

✅ Week 1: Download NISM Series XIII Common Derivatives syllabus, enroll in prep course

✅ Week 2-4: Complete 50+ practice MCQs daily

✅ Week 5-6: Attempt 2-3 mock exams (target: 70%+)

✅ Week 7: Schedule NISM exam

✅ Week 8: Pass exam, activate SIF distributor status

✅ Week 9: Email 20 HNI clients about SIF opportunity

SIFs represent a once-in-a-decade market shift. With ₹2,010 crore AUM in just 30 days of launch, and ₹23,000+ distributor positions opening by 2026, the question isn't if you should add SIFs to your practice—it's when.

Higher commissions, better client retention, and future-proof skills make SIF distribution a no-brainer upgrade for any financial advisor.

📚 Explore Daanik's NISM XIX-A Certification Course – Prepare for your exam in 6-8 weeks with:

💬 Join 500+ SIF Distributors in Daanik Community – Share wins, ask questions, stay updated

🎯 Book Free Career Consultation – Understand if SIFs fit your practice

Daanik.com

Daanik is a leading platform dedicated to empowering individuals with financial literacy, offering courses that help traders and investors build the skills needed to navigate the complexities of the market successfully.