There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

IPOs may promise high returns, but understanding their risks and performance trends in 2024 is crucial for cautious investing.

Fri Jan 17,2025

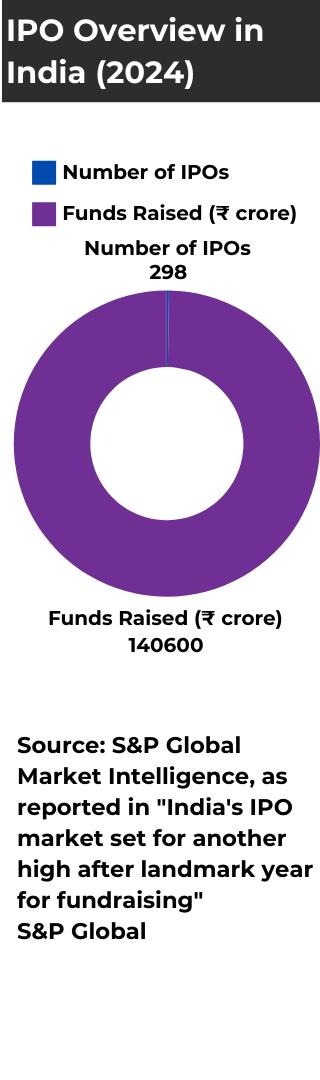

The Indian IPO Landscape in 2024: In 2024, the Indian stock market is witnessing a surge in IPO listings. According to data from the National Stock Exchange (NSE), there have been 90 IPOs in 2024, with an approximate total amount raised of ₹60,000 crore (about $7.2 billion). This indicates a strong confidence in the Indian economy, with many businesses keen to go public to tap into investor funds. However, despite the growth in the number of IPOs, the performance of many has not lived up to expectations.

From January to December 2024, 45% of IPOs listed below their issue price on the first day of trading, reflecting the volatility and uncertainty that often surround new listings. Among the 55% of IPOs that listed with a gain, only 25% of them sustained those gains after six months, showing that short-term returns may not necessarily indicate long-term success.

Key Metrics to Evaluate an IPO:

Top Performers and Underperformers in 2024:

Conclusion

Investing in IPOs in India in 2024 offers both opportunities and risks. While some IPOs have provided stellar returns, a significant number of them have underperformed, and investors have suffered losses. Key factors to consider when evaluating an IPO include the P/E ratio, financial health, market conditions, and corporate governance. As with any investment, due diligence is crucial. For those eager to tap into the IPO market, caution is advised. Consider these investments as a part of a diversified portfolio, and ensure that you are aware of the potential risks before diving in.While the allure of quick gains from IPOs is tempting, it is important to remember that not all IPOs are created equal. Approach them with a skeptical mindset, and only invest in those that meet your rigorous standards for long-term growth.

For more insights, check out our NISM Series XV , NISM Series XII (Research Analyst , Securities Market) courses.

Daanik

Daanik is a leading platform dedicated to empowering individuals with financial literacy, offering courses that help traders and investors build the skills needed to navigate the complexities of the market successfully.